10 Free Apps To Help Keep Your Finances In Order

Each day it seems like the app market is releasing a new tool to help consumers simplify their money. From setting bill reminders to automatically creating detailed financial charts, there is always something new to learn with the help of a smartphone. These apps provide a resource to easily plan a budget, start saving for a big purchase, or keep track of available spending cash.

Mint.com

A secure tool that simplifies the user’s financial accounts to enable easy budgeting and tracking of financial goals. Organize a mortgage account, savings, checking, and investments with helpful graphs and timely alerts.

Key Features:

- Set up automatic alerts, like bill reminders

- Stay safe with 128-bit SSL encryption

- View graphs to make tracking your finances simple

- Find savings through personal recommendations

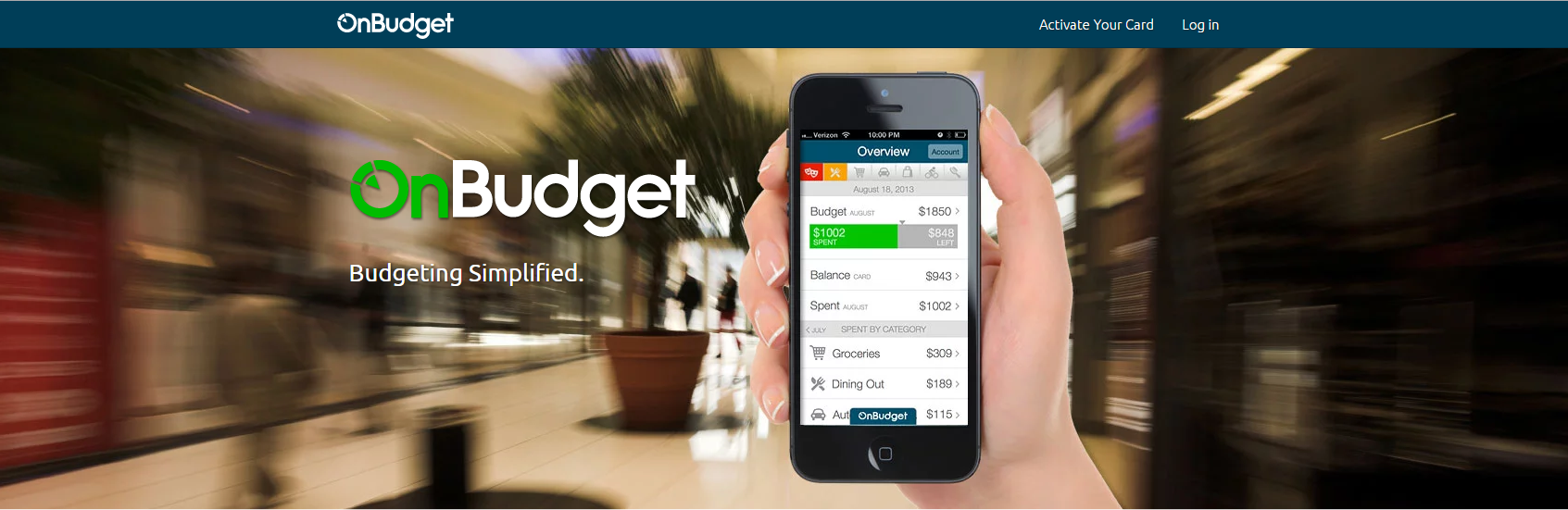

Onbudget.com

Manage any budget and avoid overspending by keeping track of daily spending habits. Use the OnBudget Mastercard to handle expenses with an allotted amount of money to effortlessly increase savings.

Key Features:

- Pay no fees

- Set up two-user integration

- Access budget advisors free

- Use any bank account to set up weekly, monthly, or bi-monthly auto-loads

- Track data in real-time

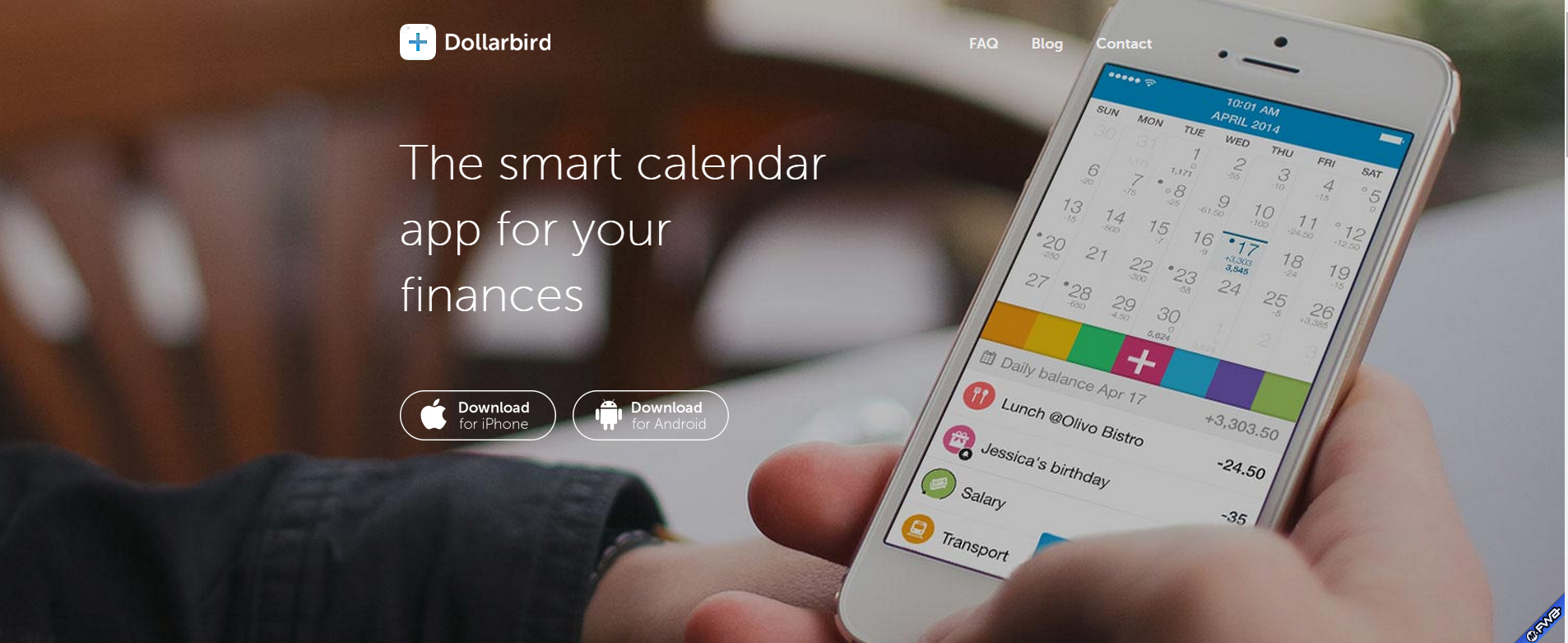

Dollarbird.co

Enter detailed figures on a daily basis to manage a budget with the help of income and expense reports. There is no need to risk sharing sensitive banking information with the app to organize finances.

Key Features:

- Organize expenses into categories

- Multitude of pre-configured expense categories

- Estimate financial projections

- Receive monthly bill reminders

- Setup recurring transactions

- Maintain multiple calendars

- Income, monthly balance, income vs. expense graphs

- Visual budget display for the graphics-oriented

- Enjoy automatic balance calculations

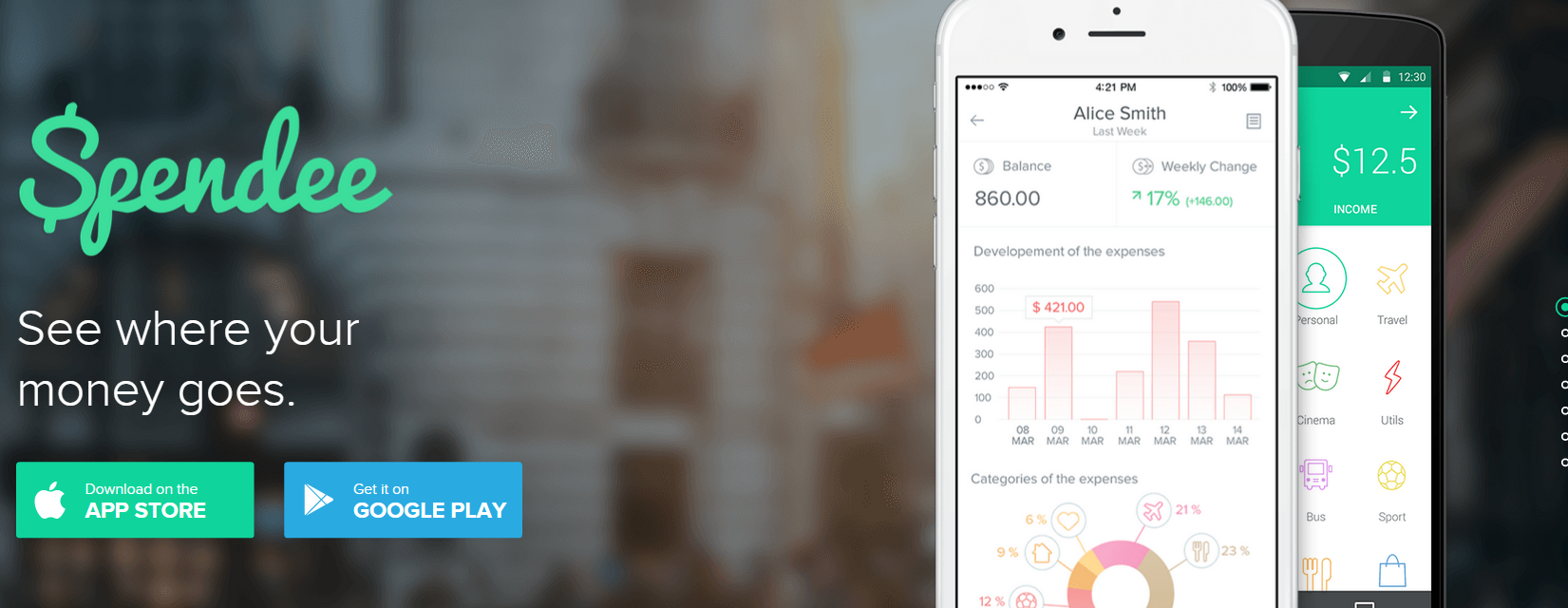

Spendeeapp.com

Keep a detailed record of every single transaction by adding income details and expenses. The user-friendly design is pre-configured with categorized expenses for quick entry at the point of a finger.

Key Features:

- Visualize your income, expenses and spending trends

- Charts and graphs display financial history

- Percentage breakdown of spending by category

- Timeline view shows when you tend to spend the most

- Biggest purchase and month-over-month change stats

- Discover where your money is going with category options

- Receive updates in your feed

Levelmoney.com

Levelmoney.com

Never exceed any set budget with the help of a detailed reference tool providing the amount of available spending cash. The app connects with 250 of the top banks in the United States to make it easy to provide details regarding income, bills, and savings.

Key Features:

- Ensure information security with 128-Bit Encryption

- Simple, straightforward cash flow monitoring

- Setup savings plans and hide your savings from your view

- Enjoy automatic updates without having to enter transactions manually

- Get automatic calculations showing reoccurring transactions

- See projected savings data

Learnvest.com

Learn new ways to manage money with powerful financial tools, while monitoring the progress of current and long-term goals. It is a helpful tool to plan for the future and learn to effectively set up a budget according to the 50/20/30 rule.

Key Features:

- Receive guidance from experts

- Work with your own LearnVest Planner

- Accept challenges to prove your financial prowess

- Add your transactions on-the-go

- Set goals and monitor progress

- Track your savings and expenses

- Link accounts to the app securely

Cost:

- FREE standard app

- Portfolio Builder: $19.99/month (+ $399 one-time setup fee)

- 5-Year Planner: $19.99/month (+$299 one-time setup fee)

- Budget Starter: $19/month (+$89 one-time setup fee)

Youneedabudget.com

Easily keep all devices in sync with cloud-based financial data storage. Users can take advantage of effective budgeting tips, savings strategies, and an in-depth analysis of spending trends to start making smarter financial decisions.

Key Features:

- Keep your data safe with PIN access

- Create different budgets for personal and business use

- Sync with all your devices

- View transaction data on various accounts

- Unified account view shows all data in a single dashboard

- Spending quick-view

- Powerful search for locating specific transactions

- Schedule transactions for recurring bills

- Embed notes in-context with transactions

Doxo.com

Manage monthly expenses and keep track of bills paperlessly with statements delivered straight to the app. Doxo can be configured with different lenders and services to put all accounts into one place.

Key Features:

- Create a personal directory

- Store receipt photos, insurance cards, invoices, etc.

- Backup your data on the cloud

- Store account numbers, passwords, etc.

- Contact companies straight from the app

- Receive and pay bills within the app using DoxoPAY

- Track payment history

Savedplus.com

People that have a difficult time saving extra money have the opportunity to effortlessly set aside a customizable percentage of every transaction. No maintenance is necessary to start building up enough savings to make a large purchase or even start investing.

Key Features:

- Ensure your information is secure with encrypted data

- Use the web portal, mobile app or both

- Set customized percentages on how much to save per transaction

- Set up only certain transactions to result in savings

- Track your savings

- Build an emergency fund or save for a big-ticket wish list purchase

- Save enough to make your credit card payment each month, invest or donate

Walla.by

Take advantage of available rewards when shopping online by automatically calculating which card provides the best deal. It is especially useful to individuals managing multiple cards offering varied incentives and benefits.

Key Features:

- Stop worrying about which card to use to get the best rewards

- Find local shops running deals on your credit cards

- Connect to all your credit card accounts

- Only pay your regular credit card bills without having to worry about Walla.by-related fees

- Walla.by apps for Pebble and Glass

- Browser extension to save money and maximize rewards on your desktop

Do you use an investment app to keep track of your credit cards? Has an organizational app helped you learn to manage your daily finances? Have you started a savings plan provided by a feature built into an app? The digital age has provided so many resources to enable anyone to get started on the path to financial prosperity. Contact Georgette today for more tips and advice.