Understand Your Credit Report Once and For All

The information contained on a credit report is a tool that lenders use to decide if a person is in a positive financial situation. It’s important to be able to actually understand each section of the report to figure out ways to boost the score for a greater chance at being approved for a loan with a fair interest rate. Reviewing the report at least once a year also provides an opportunity to spot any errors negatively impacting the score and ensuring that there are no issues with identity theft.

The Anatomy of Your Credit Report

A total of four main sections divide a credit report into an easy to navigate record of financial history. Personal information verifies the owner of the report, public record information highlights any financial legal issues, creditor information details all relevant lines of credit, and the adverse accounts section is the part that contains outstanding balances and collections.

Personal Information

This is pretty self-explanatory, but this section generally includes:

- Your name and aliases

- Social security number

- Date of birth

- Employment data

- Current address

- Previous address

Public Record Information

If you have any open legal issues related to your financial situation, they’ll be included in this section. These records might be:

- Bankruptcies

- Liens

- Judgments

- Wage garnishments

Creditor Information

Here’s the meat of your report. All of your existing lines of credit are included in this section. If you’ve had any credit turned over to a collection agency, that’ll be included, too.

- The status of the account: Current/open, closed, charged-off (sent to collections)

- The responsibility of the account: Joint or individual

- Your account balance

- Your most recent payment

- Past due information, if applicable

- Your credit limit

Adverse accounts, potentially negative items

One of the first places that a lender will check for reasons to deny a loan displays every late payment, outstanding balance, and account that ended up in collections. Unfortunately, an isolated problem in the past can still show up in this section until seven years have passed. If there is a mistake, Experian, TransUnion, and Equifax each provide the chance to dispute the adverse account for a chance of early removal.

Terms to know

- Charge-off, Payment after charge-off: If the status of your account is “charged-off,” this essentially means the creditor has given up on you, charging the amount off as a loss. Usually, they’ve sent your debt to collections. If you made a payment after a charge-off, it won’t be removed from your account.

- Open account: These are less common to see on your credit report. They’re accounts that require you to pay the balance in full each month. A utilities company, for example.

- Collection account: If an account has been transferred to a third party collection agency, that credit shows up as a collection account, even if you’ve settled the amount.

- Revolving account: If your account type is revolving, it’s likely a credit card. These are accounts that you don’t have to pay in full every month. You have the option to revolve your credit and pay interest on the amount you revolve.

- Installment account: Usually loans. These are accounts with fixed payments over a fixed time period.

Learn The Codes

Credit status codes and abbreviations are important to understand in order to truly understand the report. These are some of the most common and a brief explanation of their meaning:

- CURR ACCT: Account is current, in good standing

- CUR WAS 30-2: Account is current but was 30 days late twice

- PAID: Account balance paid off, inactive

- CHARGOFF: Unpaid balance charged off, credit grantor no longer seeking balance (likely has been sent to collections)

- COLLECT: Account is seriously past due and has been sent to collections

- FORECLOS: Property was foreclosed

- BKLIQREQ: Debt forgiven via Chapter 7, 11 or 13

- DELINQ 60: Account 60 days past due

Credit Inquiries

This section includes individuals or businesses who have pulled and reviewed your credit report. It might include a bank at which you opened an account, for example. Or a mortgage lender, if you’re applying for a home loan. According to College Answer, there are two types of inquiries.

- Hard Inquiries: Made by lenders when you’ve applied for a loan or line of credit. If too many are made within a certain time frame, this can count against your credit score.

- Soft Inquiries: Made when you check out your own credit report or when a marketing agency “pre-approves” you for a line of credit.

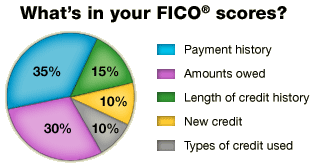

How Your Fico Score is Calculated

MyFICO.com says your credit score is based on five cateogries. Here’s a breakdown.

- Payment history (35%): Payment history reflects whether you’ve paid past accounts on time. So if you’re good about making payments on time, your credit score will increase. According to the site: “A few late payments are not an automatic ‘score-killer.’ An overall good credit picture can outweigh one or two instances of late credit card payments.”

- Amounts owed (30%): Lenders what to know how much you owe. If you’re close to reaching your credit limit for an account, (“maxing out”), this may negatively affect your credit score, the site says.

- Length of credit history (15%): A longer credit history will increase your FICO score, according MyFico.com. FICO also takes into account how long you’ve been actively using those accounts.

- Types of credit (10%): Your score considers your mix of credit cards, installment loans, retail accounts, mortgage loans and finance company accounts. It also looks at the amount of accounts you have open. MyFico adds that closing an account doesn’t make it go away; it will still show up on your report.

New credit (10%): Inquiries into new lines of credit can lower your score.

Dispute Any Mistakes

Negative marks on a credit report may be caused by an unexpected medical expense or brief period of financial trouble. However, if there is an error that would lead a lender to believe that it would be too risky to approve a loan, it’s worth the effort to file a dispute. The major credit bureaus accept claims online and through the mail to provide a chance to have false information removed.

You need to stay current with your credit report so that you know exactly why you have a certain score. If you give us a call, we would be happy to provide more information about reading your credit report and finding ways that you can improve.